For those who have never considered all of the legal and financial problems that can plague you or your family after a death– you might want to take a look at Die$mart: 11 Mistakes That Cost Your Family Money When You Die, the 2009 book by Kathy Lane and Christine Hughes. This short 225-page guide walks you through some very important considerations and claims to help the reader avoid “dying dumb.”

For those who have never considered all of the legal and financial problems that can plague you or your family after a death– you might want to take a look at Die$mart: 11 Mistakes That Cost Your Family Money When You Die, the 2009 book by Kathy Lane and Christine Hughes. This short 225-page guide walks you through some very important considerations and claims to help the reader avoid “dying dumb.”

So what is “dying smart,” as opposed to “dying dumb”? Basically, “dying smart” is accepting that you are going to die, and preparing for it: from making a living trust to creating advance care directives to considering what will happen to your minor children. These are all actions that will lessen the burden, legal, financial, and otherwise, on your family. Unlike 100 years ago, when dying at home from acute illness or accident was common, most people today die in the hospital. 80% of us will pass away from a prolonged illness like cancer, Alzheimer’s, or a respiratory failure. This “new” way of dying has brought with it a host of new issues that most people have never even considered.

Lane and Hughes take what could be an overwhelming subject and boil it down to the nitty-gritty– a nice, concise walk-through. Lists of “Words to Know” at the beginning of each chapter helps the reader navigate the legal jargon. Icons indicate where state laws may vary, and direct the reader to the very helpful Die$mart website. “Family Stories” in each chapter help put human names and faces to otherwise complicated legal situations. We meet people like Marsha, whose incapacitated husband Roger never named her his durable power of attorney, and as such forced her to pay exorbitant legal fees to engage in transactions in his name. We meet Josephine, whose stepchildren will fail to inherit any of her late husband’s assets if she dies without naming them in her own will.

The book’s greatest success is simply the fact that it prompts the reader to start thinking about after-death issues. You don’t necessarily have to follow every recommendation. But too many of us ignore the glaring reality that we will die, and are not cognizant of the myriad issues that can spring up for our loved ones when we do. Simple things like making a will, making a living trust, naming a health care power of attorney: these are not a waste of time, rather these are vital, practical steps in planning for your own death– and life!– and the lives of the people you love.

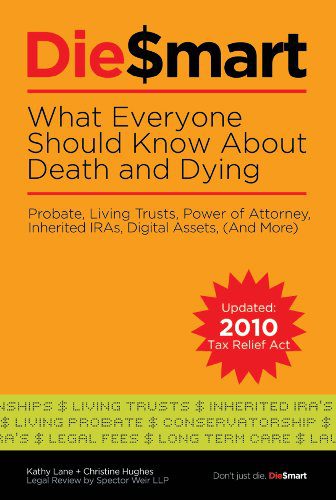

Die$mart, by Kathy Lane and Christine Hughes

Die$mart, by Kathy Lane and Christine Hughes

Passing of Beloved Comedian Births a New Comedy Festival

Passing of Beloved Comedian Births a New Comedy Festival

The Spiritual Symbolism of Cardinals

The Spiritual Symbolism of Cardinals