One of the most grueling tasks to accomplish when a loved one dies is, unfortunately, unavoidable: closing up all of their legal and financial obligations they had in life. Without prior arrangements, fully closing the affairs of a deceased loved one can take up to two years.

What makes it worse is that, since most people choose an executor by designating their closest, most trusted friends or family members, it means that the person who needs to perform this drudgery is typically in mourning. The last thing you want to have to think about if you’ve recently said goodbye to someone very close to you is paperwork. Your grief might be overwhelming, and the fortitude necessary for fighting with credit card companies and utilities reps might seem elusive.

That’s why it would be an incredible act of love to create an “In Case of Death” file for yourself, with all the information necessary to perform these tasks. As you’re probably aware, without the proper documentation, account information, and passwords that we use on a daily basis, it can be nearly impossible to gain the access necessary to close up shop. Here’s how you can help your loved ones so they can focus on dealing with their grief, instead:

How-to Suggestions

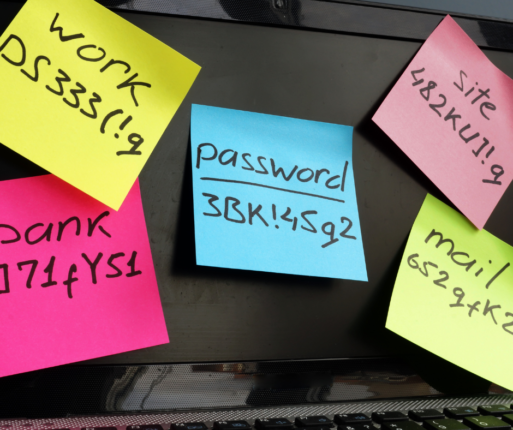

- Designate one place to store all your pertinent information. It can be a desk drawer, a shoebox on the top shelf of your closet, a folder on your (personal!) computer, or a locked document on your phone. Make sure you can keep the information in it secure somehow, but also be sure to tell someone you trust where it is and how to access it. (It won’t be any help to your executor if they don’t know the file even exists.) If you are using digital means to store this information, make sure any passwords that are needed to access the files are available to pertinent trusted people.

- Gather ALL your important personal documents/information. This should include your Social Security card, certificates pertaining to weddings, divorces, citizenship, or name changes. (Or at least images of these items, if digital.) Make a list with contact information for doctors, lawyers, close friends, or organizations you belong to. Include any legal documents like a will or living will.

- Assemble your financial information and records. Gather the necessary info to access your bank accounts, credit cards, insurance (health, auto, home, etc.), investments, and tax returns. Get copies of any mortgage documents, rental agreements, and car title and registrations.

- Make a list of all the bills you pay each month. Think about all the accounts, big and small, like the ones for your cell phone, any streaming subscriptions, and membership fees. Yes, this data should be in your bank statements, but if you have them neatly listed it will make it so your executor doesn’t have to play detective, and can check them off one by one.

- Be sure to include any usernames and passwords needed. List the code to unlock your phone, your computer password, email accounts, and any social media accounts that you access regularly. That way, your loved ones can use these to communicate about your death (if they choose) or easily close them out.

Our Monthly Tip: Make an “In Case of Death” File to Ease Loved One’s Grief

Our Monthly Tip: Make an “In Case of Death” File to Ease Loved One’s Grief

Who Cares for the Caregivers?

Who Cares for the Caregivers?

Final Messages of the Dying

Final Messages of the Dying