Despite many medical advances in recent decades, American’s life expectancy is on the decline. Two studies by the National Center for Health Statistics found that more Americans are dying at younger ages (under the age of 65) than in the past two decades. And this change in life expectancy could impact pensions and other retirement benefits in the future.

The rise in death rates among younger Americans has already changed how some companies plan for their employees’ retirements. For instance, both Verizon and General Motors have reduced their pension estimates based on this new data, according to Bloomberg. In total, Bloomberg estimates that corporations in the United States have decreased their planned pension and retirement spending by about $9.7 billion combined.

This is a new trend. In the recent past, steadily increasing life expectancy led to increased spending on pensions and other retirement benefits every decade.

Credit: Wikimedia.org

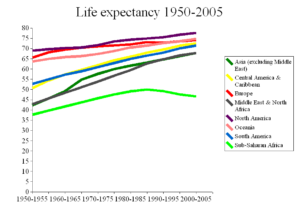

For example, in 1950, the average lifespan hovered around age 68. And employees couldn’t claim full retirement benefits until age 65. Even if some employees retired early, most companies planned for less than 10 years’ of pensions and other retirement benefits, on average.

Today, the average life expectancy is nearly 10 years longer than it was in 1950. As a result, companies have to budget for 10 more years of retirement benefits than they did in the past. But now that we’re seeing increasing death rates among younger Americans, they may start to invest less money in pension plans, especially if the average life expectancy continues to drop.

Although the recent decrease in life expectancy seems small (dropping from age 78.9 to age 78.8 in 2014), it’s a concerning trend. From the 1950s through the 1990s, healthcare advances brought about a steady increase in life expectancy in the United States. These new advances, such as statins for heart disease, have helped the death rate decrease nearly every year. However, progress has stalled since 2010. And in 2015, for the first time since 1990, life expectancy went down.

Credit: Flickr.com

Researchers consider two possible reasons for this plateau in life expectancy. The first is that our healthcare system is worsening, and we aren’t focusing as much as we should on preventative care. The fact that many of the deaths in younger people occur as a result of obesity, poor diet, alcohol or drug abuse and suicide supports this idea.

The second theory is that we’ll need a new medical discovery, similar to statins and vaccines in the past, to experience another dramatic increase in life expectancy. For example a cure for cancer or the discovery of a medication to treat Alzheimer’s would ramp up the average life expectancy once again. If this happens, it’s likely that companies will have to save even more for their employees’ retirements than they already are.

The problem many companies face now is uncertainty. Until researchers find the cause for the dip in life expectancy and determine if it will continue to decline, companies aren’t sure how to plan for each employees’ retirement. In the future, this could lead to more retirees being surprised when the time comes to collect their pensions.

Want to learn how Americans view their life-expectancy? Check out our article, “How Long Is Too Long?”

A Decrease in Life Expectancy Could Impact Pensions

A Decrease in Life Expectancy Could Impact Pensions

Final Messages of the Dying

Final Messages of the Dying

Will I Die in Pain?

Will I Die in Pain?