Credit:nerdwallet.com

There is arguably no pain greater than that of losing a child or seeing your child become permanently disabled. In fact, when most of us hear stories of such tragic loss, they inspire in us compassion, empathy and a desire to help. So it seems inconceivable that a government agency would act in a way that would actually compound bereft parents’ grief. But that’s exactly what has been happening in New Jersey, as the state sought to collect student loan debt from parents whose child had died.

Now the practice is coming to an end, thanks to an investigation led by the New York Times and ProPublica into the state’s Higher Education Student Assistance Authority. On Dec. 5, 2016, Gov. Chris Christie signed into law a bill that requires the agency to forgive student loan debt for any child who dies or has a permanent disability.

The law comes on the heels of a legislative hearing during which state lawmakers looked at the agency’s handling of about $1.9 billion in student loans. The legislature took action after Christie, who appointed the head of the agency and has veto power over its decisions, failed to respond to the Times and ProPublica reports.

At the hearings, dozens of families testified about the aggressive debt collection tactics the state loan agency employs. For example, Marcia DeOlivera-Longinetti, the mother of a young man who was murdered, told of being forced to continue paying his $16,000 student loan debt after he died. Likewise, a young man spoke of being sued by the state for $250,000 in student loans after he got cancer and lost his job.

According to ProPublica, the number of lawsuits filed by the agency has also risen dramatically in recent years. In 2010, the state filed fewer than 100 lawsuits to collect student loans. That number reached 1,600 by 2015.

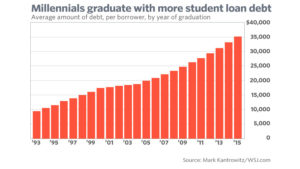

Student loan debt is rising every year

(Credit marketwatch.com)

The testimony and the contents of the investigative reports appalled many lawmakers present at the hearing. One of the strongest reactions came from Sen. Robert Gordon (D), who chairs the Legislative Oversight Committee. “We need to end this program, start over from scratch and find ways of providing assistance for students so that they can get an education without it bankrupting them,” he said.

More Reforms Sought

The new law brings New Jersey’s policies more into line with the federal student loan program, which allows forgiveness of student loans for children who die or are permanently disabled. Since students’ parents often co-sign these loans, the policy protects hundreds of families from potential financial ruin.

Nevertheless, New Jersey lawmakers are not yet satisfied, and have introduced a number of bills aimed at modifying HESAA’s practices. For example, current law grants the agency the authority to garnish wages, seize income tax refunds and suspend professional licenses without a court order if a borrower falls behind in repaying a student loan. It also does not provide for a repayment schedule based on income, which federal law does.

The pending legislation addresses both of these concerns.

New Jersey Will Forgive Student Loan Debt for Kids Who Die

New Jersey Will Forgive Student Loan Debt for Kids Who Die

Final Messages of the Dying

Final Messages of the Dying

Will I Die in Pain?

Will I Die in Pain?