Credit: Reader’s Digest, Bronek Kaminski

“Smishing” is the latest fad in financial fraud. Every year millions of Americans, many of them elderly, fall prey to some type of scam. These scam artists are able to defraud unwitting cellphone users out of $3 billion annually. As the elderly population grows in the U.S., it’s possible that con artists will find even more people to scam.

Common Types of Smishing Scams

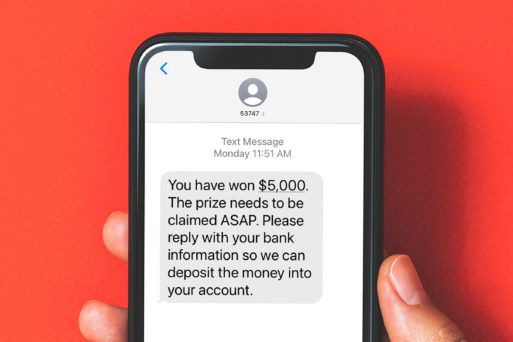

- Sweepstakes/Charity/Lottery Scams – Criminals claim to work for a charity to gain victims’ trust and/or sympathy. They also claim the recipient won a large sum of money so that the victim will have to share their personal information to claim it.

- Romance Scams – Perpetrators pose as potential romantic partners that elders may meet on dating sites or chat rooms. These scammers attempt to capitalize on people’s desire to find a companion.

- Government Impersonation Scams – Scammers pose as government officials and threaten to arrest or prosecute victims unless they send money.

- Grandparent Scams – Criminals pretend to be the victim’s grandchild, who is in desperate need of financial assistance.

- Tech Support Scams – Perpetrators pose as IT support and offer to fix non-existent technology problems, asking for remote access to the victim’s computer and/or cell phone.

How to Defend Yourself

You can take the following steps to protect yourself from smishing.

- Recognize scam attempts and end all communication with the criminal. You may be able to block their number and/or report it so that others will know to ignore these texts and calls.

- Search online for the contact information (phone number and any other information you have) and the proposed offer. Many times, others have already reported the number that attempted to contact you as a scam.

- Resist the pressure to act quickly. Scammers often create a sense of urgency to produce fear. No text message or call needs to be responded to immediately.

- Never give or send any personally identifiable information, money, jewelry, gift cards or checks — or wire information or funds — to unknown or unverified persons or businesses.

- Do not open any emails or click on attachments you do not recognize, and avoid suspicious websites.

- If a perpetrator gains access to a device or an account, take precautions to protect your identity. Contact your financial institutions to place protections on your accounts, and monitor your accounts and personal information for suspicious activity.

Final Thoughts

If you are the victim of a smishing scam, you must file a claim against the perpetrator(s); your experience may help others avoid financial losses in the future. After filing the claim, you should also contact all three credit bureaus, your financial institutions, law enforcement, the Social Security Administration and your family. Though your family may be upset with you for falling for a scam, show them you are capable of managing your affairs by taking the necessary steps to rectify the situation.

Remember, if you are a victim of smishing or any other type of fraud, you should not feel ashamed. These criminals are very experienced in gaining people’s trust and pressuring people to share valuable information and resources with them. If you feel embarrassed about the situation, you may not seek help or recoup your losses. However, by filing a claim and reporting the crime, you may help others to avoid the same losses in the future.

“Smishing”: The Latest in Elder Fraud

“Smishing”: The Latest in Elder Fraud

Final Messages of the Dying

Final Messages of the Dying

Will I Die in Pain?

Will I Die in Pain?